#1 Making the 'Net a utility—what’s the worst that could happen

Posted: Fri Dec 19, 2014 2:08 am

This is a dense article, with quite a bit of information - but it breaks down the arguments that larger ISP's are using to try to fight against the idea of communications (which would include mobile devices, regular telephones, as well as how the Internet is connected to) being treated as a utility for everyone. I recommend reading through it if you can, since it brings to light the truth behind some of the hyperbole and talking points being seen about this.arstechnica.com wrote:There seems to be nothing the broadband industry fears more than Title II of the Communications Act.

Title II gives the Federal Communications Commission power to regulate telecommunications providers as utilities or "common carriers." Like landline phone providers, common carriers must offer service to the public on reasonable terms. To regulate Internet service providers (ISPs) as utilities, the FCC must reclassify broadband as a telecommunications service, a move that consumer advocacy groups and even President Obama have pushed the FCC to take.

Under Obama's proposal, the reclassification would only be used to impose net neutrality rules that prevent ISPs from blocking or throttling applications and websites or from charging applications and websites for prioritized access to consumers. The FCC would be expected to avoid imposing more stringent utility rules in a legal process known as "forbearance."

Although Title II offers perks that help providers build out networks, ISPs and telecom industry groups have argued that Title II would bring a host of oppressive regulations that the FCC would have a hard time not imposing. They claim that Title II will impose so many extra costs that they’ll be forced to raise prices—though customers might point out that ISPs aren’t shy about raising prices to begin with.

So what, exactly, are ISPs afraid of? We wanted to find out what the worst-case scenario for broadband providers is. Hypothetically, assuming the FCC were to impose all possible Title II regulations (even though Obama specifically said he doesn’t want that to happen), what kinds of new regulations would ISPs have to follow and what new costs would they absorb? And would consumers pay the price in higher bills and worse service?

The cable industry has a lot to say on this subject

To get answers, we spoke with the biggest cable industry trade group, the National Cable & Telecommunications Association (NCTA). It represents cable providers such as Comcast, Time Warner Cable, Cox, Cablevision, and Charter.

One big requirement Title II could bring is regulation of rates charged by Internet providers, either imposing a uniform limit on what all providers can charge or forcing each one to get permission for price increases and justify them based upon the amount they invest in their networks.

Theoretically, the FCC could also enforce “local loop unbundling,” which would force network operators to lease access to last mile infrastructure. In turn, this could bring a new set of competitors who would resell Internet service over the incumbents’ networks without having to lay their own wires throughout each city and town, similar to how the DSL market operated before the FCC removed the unbundling requirement in 2005.

On the plus side for cable companies, the NCTA is confident the FCC won’t enforce local loop unbundling.

“Unbundling in the [Communications] Act, is under Section 251C, which only applies to incumbent local exchange carriers,” Steve Morris, the NCTA’s associate general counsel, told Ars.

An incumbent local exchange carrier, or “ILEC,” is a telephone company that held a regional monopoly before the markets were opened to competitive local exchange carriers or “CLECs.”

“Our preliminary view is that there’s no way you could find that an ISP is an incumbent local exchange carrier, so those provisions should not apply to ISPs,” Morris said. Landline phone companies that also offer Internet service, like AT&T and Verizon, are still ILECs and could theoretically be subject to unbundling. But this isn’t likely given that the FCC abandoned unbundling nearly a decade ago.

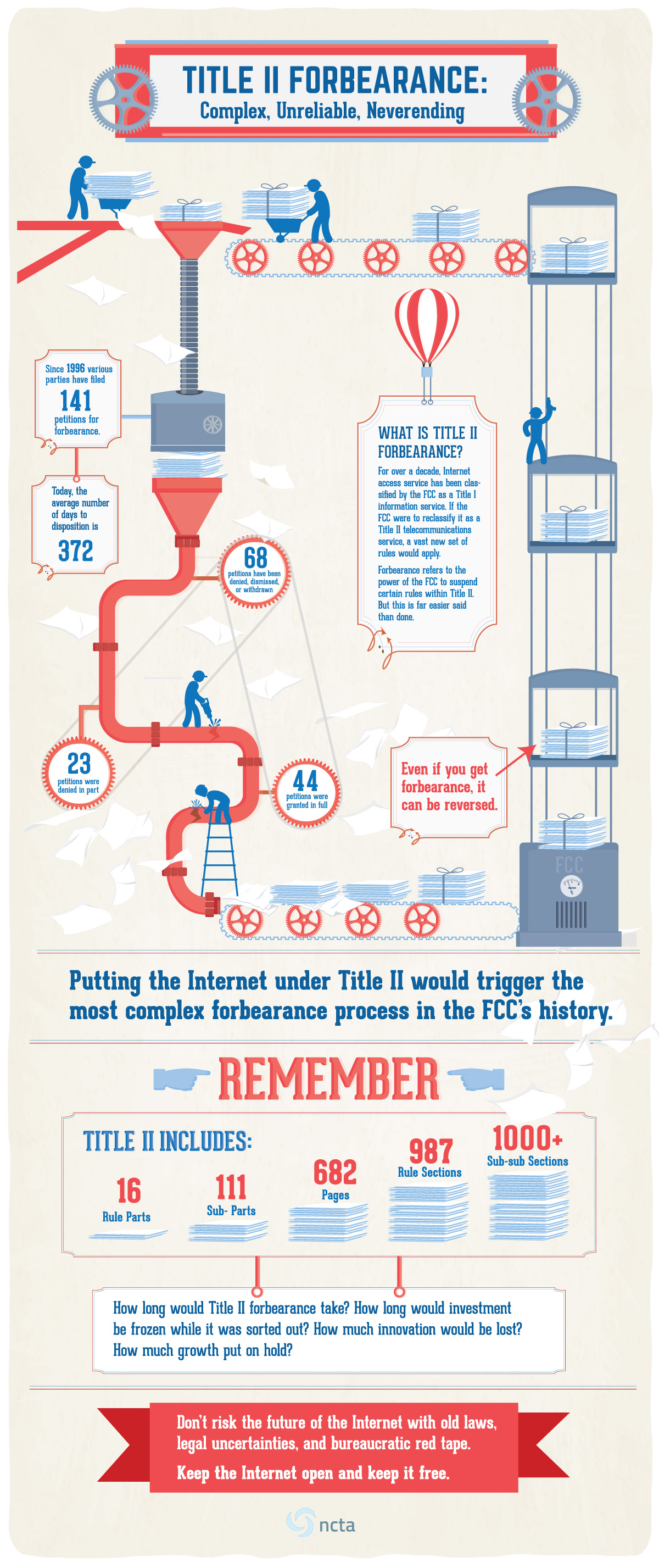

While other Title II regulations wouldn’t necessarily apply to Internet providers because of the FCC's forbearance powers, industry groups argue that forbearance is a highly complicated process that will make it difficult for the FCC to avoid imposing common carrier rules that go far beyond net neutrality.

“I think the thing that worries people the most is probably rate regulation,” Morris said.

There are multiple markets in which the FCC could regulate the rates charged by Internet providers. The most obvious one is the prices charged to residential and business customers who subscribe to broadband. The NCTA doesn't seem worried about that.

“Most people seem to say the commission could forbear from that,” Morris said. “The president seemed to say there was no need for that sort of regulation.”

More likely, though, is regulation of the interconnection deals Internet service providers strike with other large network operators such as Level 3 and Cogent and online content providers such as Netflix. Netflix and others have called upon the FCC to mandate “settlement-free peering,” interconnection deals that happen without payment. Traditionally, payment-free interconnection has only been available in cases where the ISP and the entity it connects to exchange a roughly equal amount of traffic. Netflix wants free network access regardless of whether the traffic is balanced, and the site could get its wish with Title II.

“Netflix and Level 3 and Cogent have all been pushing for mandatory, settlement-free interconnection and traffic exchange,” Morris said. “Well, that’s rate regulation. You know, saying that someone has to do something at a zero price, that’s rate regulation.”

The primary goal of net neutrality advocates is to outlaw paid prioritization deals in which online content providers pay to have their traffic sped up over the so-called “last mile,” the path from the edge of an ISP’s network to a consumer’s home. (ISPs have not struck any such deals yet, but they could because the FCC's prior net neutrality rules were overturned in a court order in January 2014.) Interconnection is different from paid prioritization; it occurs only at the edge of an ISP's network where it connects to the rest of the Internet and would not be affected by most net neutrality proposals.

The FCC is reviewing interconnection deals but hasn’t said whether it plans to regulate interconnection rates. With Title II, it could insist on reasonable rates without necessarily requiring that interconnection be free. “Reasonable” would be left open to interpretation and decided on a case-by-case basis when there are complaints.

Harold Feld, an attorney and senior VP of the pro-Title II group Public Knowledge, pointed out that Section 251A of Title II requires telecommunications carriers to interconnect with other carriers. A requirement like this could have helped force Comcast’s hand when it was demanding payment from Cogent in exchange for upgrading links used to carry Netflix and other traffic. That dispute was settled indirectly when Netflix paid Comcast, but customers suffered from worse performance in the meantime.

Assuming Cogent was also considered a telecommunications provider, “the FCC could say, ‘look, you’re not allowed to sit there and do nothing when you’re faced with capacity constraints,’” Feld told Ars. “‘There has to be some way in which you upgrade to meet the capacity demand when it’s clear there is capacity demand.’ They could even say generally, ‘your pricing has to bear some relationship to cost.’”

Under Title II, Netflix could also complain to the FCC if it believed Comcast and other ISPs were charging unreasonable rates for interconnection, because Netflix would be a customer of a common carrier, Feld said.

But rate regulation isn't something the FCC does lightly. The commission has spent years gathering pricing data on the special access market, in which businesses such as Sprint and T-Mobile buy bandwidth from the likes of AT&T, Verizon, and CenturyLink, without making any final decision.

New taxes or just scare-mongering?

Although rate regulation on the consumer side could involve a mandate to keep broadband affordable for ordinary people, anti-Title II groups are arguing that utility status will bring new taxes that would cost customers billions of dollars a year.

“We have calculated that the average annual increase in state and local fees levied on US wireline and wireless broadband subscribers will be $67 and $72, respectively,” economists Robert Litan and Hal Singer argued in a policy brief by the Progressive Policy Institute this month. “And the annual increase in federal fees per household will be roughly $17. When you add it all up, reclassification could add a whopping $15 billion in new user fees.”

This analysis has been met with skepticism. For one thing, the US government bans state and local taxes on Internet service, potentially wiping out a large portion of the charges Litan and Singer predict. The moratorium has been in place for 15 years, and Congress just renewed it again. (Singer argues that their analysis focuses mostly on fees that are not outlawed by that moratorium.)

On the federal level, the hypothetical new fees would come from the Universal Service Fund (USF), which pays for broadband infrastructure in underserved areas with money collected as surcharges on phone bills.

Pro-Title II groups disagree with Litan and Singer, saying that the FCC wouldn’t have to impose USF charges on broadband. “On the matter of new federal and state USF fees, the FCC could decide to waive the requirement for providers to contribute a portion of their retail broadband revenues to the federal USF,” wrote Matt Wood, policy director of consumer advocacy group Free Press. “The Commission could do this because a cost-benefit analysis might show that the additional fees would depress overall broadband adoption among poor and elderly communities—which would go against the USF’s very mission.”

Besides that, Wood argued that the Universal Service Fund could remain the same size, so that surcharges on broadband would be offset by reductions in surcharges on wireless and wired phone lines.

Singer made a point-by-point response to Wood’s rebuttal, and the NCTA claims to be convinced that Title II will bring some onerous new fees. Litan and Singer supplied “an important analysis which demonstrates that consumers will be on the hook for billions of dollars in new taxes and fees under a Title II regime,” an NCTA spokesperson told Ars. “The significant increase in consumer taxes further demonstrates why Title II should be rejected. If connecting all Americans to broadband service is a true national priority, imposing billions of dollars in new taxes on this service is a perplexing way to accomplish that goal.”

Big Cable's multi-faceted argument, continued

Here is a summary of a few other concerns raised by the NCTA:

* The right to stop service

Broadband providers classed as common carriers might need to seek permission to discontinue service in unprofitable areas.

“For the most part that has not been a problem for our companies,” Morris said. “Usually we get into a business because we want to be in the business and we’re not planning to get out of the business. But those issues are coming up much more now on the telco side as they try to move to IP [Internet Protocol] and move to more fiber. It may not be as big a concern as some of the other things we’ve talked about but if there are a lot of hurdles we have to jump through to get out of a business or a service, it makes you have to think a lot harder about getting into it in the first place. If you have a service and you think there’s consumer interest, but you’re not really sure, you may be hesitant to try it if once you offer it you’re not going to be able to stop offering it.”

* Rules affect small ISPs, too

“Every article you read about this, it’s always Comcast, AT&T, and Verizon, and certainly a significant percent of customers get their service from those big companies,” Morris said. But there are hundreds if not thousands of small ISPs serving small areas. The American Cable Association alone represents 900 smaller operators.

“We have some small members," Morris said. "Not only do they not have the ability to charge Netflix, Netflix doesn’t even come to [their facilities]. These guys have to go somewhere to meet Netflix and pay to get there. These are companies that serve a few hundred or a few thousand customers… They’ve invested private capital in places that are hard to serve. They’re sometimes family businesses. They’re working to bring the people who live in their community good Internet service and the idea that they’re going to need to hire lawyers and other specialists to make sure they’re in compliance with a whole new set of regulations when everybody is fine with the way they offer service today, it’s crazy.”

* Pole attachment rates

Cable companies typically lease pole space from electric companies and sometimes phone companies. If cable providers were classed as telecommunications carriers, “there’d be the possibility of significant increases in the fees we’d have to pay the utilities for the exact same attachments that we have,” Morris said. “How you’re classified affects what you have to pay. It’s not a logical regime but that’s how it works.”

* Tariffs

Common carriers have to post tariffs stating the terms and conditions and rates for the services they offer, and the FCC can object to the terms and ask for changes, Morris said. The FCC has generally held that advertisements can count as a carrier’s tariff, according to Feld.

* Uncertainty

“If all the commission said was, ‘residential broadband Internet access service is subject to Title II,' everyone would have to work through what does that mean, which statutory provisions apply, which rules apply, and in some cases it’s not necessarily going to be clear, which will lead to disputes or at least the need for clarification,” Morris said.

Morris pointed to how the FCC used Section 201 of Title II, which prohibits unreasonable charges and practices, to levy a $10 million fine on TerraCom and YourTel America in October for privacy and data security violations.

“Even though there was no actual rule governing how they would secure data, the enforcement bureau said, ‘the way you did it was unreasonable, we’re fining you $10 million,” Morris told Ars. In fact, the FCC's decision cited both Section 201 and Section 222, the latter of which covers privacy and data security violations.

Still, Morris worried that Section 201 could be applied “in the context of network management. Engineers are trying to block spam, they’re trying to worry about cyber security, and they manage the network to keep it all working, and you could see a network management practice that in the heat of the moment seems totally fine, but six weeks later a bureau chief says, ‘that was unreasonable, you shouldn’t have done that, I’m going to go after you for that.’”

Although Morris was confident local loop unbundling won’t be enforced under Section 251C, he speculated that 201 is so broad that “you could get a bureau chief who says, ‘I think it’s unreasonable to not provide unbundling, even though there’s no rule that [requires it].”

The case that maybe Title II won’t be so bad

Now that we’ve been through a worst-case scenario, is there any reason to think that Title II won’t trigger the apocalypse for ISPs and their customers after all? In fact, yes—if we take ISPs themselves at their word. While broadband providers typically offer doom-and-gloom scenarios when arguing against Title II, sometimes they go off script, especially when talking to investors.

Verizon Chief Financial Officer Francis Shammo told investors at a conference last week that Title II would not affect how the company invests in its wireline and wireless networks. At the same conference, Time Warner Cable CEO Rob Marcus noted that even Title II proponents are not pushing rate regulation.

The argument that the FCC would have trouble forbearing from imposing the strictest Title II rules was shot down by Charter CEO Tom Rutledge. “Obviously forbearance done properly could work, and we think that the fundamental objective seems reasonable," he said. In another moment of candor, AT&T last year told the FCC that Title II with forbearance is an "unqualified regulatory success story."

This is in line with arguments made by Feld. “Title II forbearance is actually so easy it makes me want to puke,” Feld wrote in one blog post, countering the industry’s argument that the process of forbearing from enforcement of specific Title II regulations is complicated and unpredictable.

In another post, Feld described the last time the FCC classified a service as Title II, when the FCC made cellular voice roaming a common carrier service in 2007. “This took remarkably little effort,” Feld wrote. “The FCC explicitly rejected the requirement to do rate regulation or a requirement to file tariffs with the prices and did not need to engage in any extensive forbearance. They just said ‘nah, we’re not gonna do that.’ The final adopted rules are less than a page and a half.”

Besides forbearance that applies to a whole industry, there are also forbearance petitions in which individual telecom companies request relief from specific regulations; one such petition from CenturyLink has already dragged on for more than a year. Here is the NCTA's take on forbearance:

Feld acknowledged that reclassifying broadband would be less straightforward than reclassifying voice roaming was. But he also pointed out that cellular phone service (voice, not mobile Internet) was put under Title II in 1993, with forbearance from many regulations that applied to landline phone service, and “the wireless industry seems to be doing OK.” Wireless Internet service could also fall under Title II if the FCC opts to reclassify.

Although Feld argues that forbearance from rules not related to net neutrality won’t be too difficult, we asked him which parts of Title II could apply to broadband providers if the FCC doesn’t use forbearance and tried to apply all possible rules.

Feld agreed with the NCTA that local loop unbundling is highly unlikely even with Title II reclassification. The FCC could enforce unbundling on incumbent phone companies that offer DSL like it used to, but there’s a question of whether they should be considered “incumbent” in the case of broadband since cable has greater market share, Feld said. The FCC also decided to forbear from imposing unbundling rules on fiber in 2003 to encourage deployment, he said.

“On the whole, I agree with NCTA on this. Structural separation—modeled on the old DSL resale model or similar to what they do in France or England—is not a real risk for any ISP,” Feld said. “That's unfortunate, in my view, but that's the reality.”

US states have largely abandoned rate-of-return regulation on phone service in which carriers' expenditures are scrutinized by the government to make sure they’re necessary, with profits then calculated based upon allowable expenditures. Price caps that aren’t tied to profits and expenses are simpler and could actually be imposed on Internet service by the FCC without reclassifying broadband. That's because of the commission’s powers under Section 706, which requires the FCC to encourage deployment of broadband and specifically says that price caps are one measure the FCC could use to achieve that goal.

Feld sees complications with price cap regulation, though. The FCC would either have to set different price caps in each market based on cost of living and other localized factors, or settle on a national price cap that would be so high as to not be meaningful in most cities and towns.

On the other hand, the FCC could use its Section 706 powers to force all broadband providers to offer an entry-level Internet package for a small fee, say $10 a month, if it believed that would encourage deployment of broadband, he said. State governments could get involved, too, though most have already deregulated telecom markets.

Sections of Title II that are likely to apply to broadband providers include 201, 202, and 208, the ones applied to cellular voice, Feld said. Those include the requirement for reasonable rates and practices; a prohibition against unjust or unreasonable discrimination in rates and practices; and the establishment of a complaint process.

Back in 2010, the FCC considered reclassifying broadband and forbearing from all provisions except 201, 202, 208, 254, and possibly 222 and 255 (see page 56). Notably, that list did not include Section 251 on interconnection or Section 203 on tariffs. Section 222 covers privacy of customer information. Section 254 lays out universal service requirements guaranteeing access to all, including rural residents and people with low incomes, while 255 ensures access for the disabled.

The discrimination and reasonableness provisions should provide the commission enough flexibility to ban discrimination against websites or applications and paid prioritization, Feld argued. That would satisfy most network neutrality advocates. A useful complaint process would be particularly important as well, because imposing Title II on broadband could strip the Federal Trade Commission of some of its powers to bring action on behalf of customers against Internet providers.

If Title II becomes reality, Internet providers can blame Verizon

The fact that Title II is being considered at all is largely due to decisions made by Verizon, which successfully sued to overturn net neutrality rules issued in 2010 by the FCC without Title II. Verizon’s victory may backfire, since federal appeals court judges said the FCC couldn't impose the restrictions it wanted to without reclassifying broadband as a common carrier service. The new proceeding could revive Title II as well as impose equally strict rules on wireless Internet service, whereas the previous rules applied the most onerous conditions only to fixed broadband.

FCC Chairman Tom Wheeler is taking his time on making a final proposal, saying he expects to be sued and wants something that is legally defensible. He argues that Title II has not harmed the cell phone market, and he has good reason to be skeptical of industry arguments. AT&T argued in May that not even Title II would allow the FCC to ban paid prioritization; as the threat of Title II became more real, AT&T and Verizon began claiming that the FCC could ban paid prioritization without resorting to Title II after all.

A “hybrid” proposal the FCC is considering would reclassify broadband providers as common carriers, but only with respect to their relationships with content providers, instead of their relationships with consumers. No one on either side of the debate seems to like this idea. Morris said a hybrid approach would bring more regulatory uncertainty; Feld said the hybrid approach “adds to the litigation risk” because it relies on a complicated theory “instead of the well-known and clear path of Title II.”

The dispute will continue for another month or so while the FCC makes up its mind, perhaps for months after that if more lawsuits are filed. Separately, the FCC has also not yet decided whether Voice over Internet Protocol should be Title II, an important matter as the traditional circuit switched phone network is being replaced by the IP-based voice services sold by broadband providers.

For now, ISPs are trying to convince the public and the FCC that they have Americans’ best interests at heart.

“There’s no one who provides Internet access who said, ‘you know, I would invest more under Title II, this would help me introduce new services,’” Morris said at the end of our phone interview. “It’s clear we’re talking about levels of bad and there’s no upside… For what consumers are getting today, they’re not going to get anything better under Title II, but it will get worse because their prices are going to go up, our cost of providing it is going to go up, our incentive to invest in it is going to go down. Let’s leave with that thought.”